There’s a spot at North Arrow Minerals Inc.’s Lac De Gras project where you can stand on an outcrop and, in the distance, see the windfarm at the Diavik diamond mine. That’s not especially surprising, given that the landscape of the barrens is relatively featureless. It’s the rock you’re standing on that makes the scene memorable. It’s a spodumene pegmatite—the host rock for lithium, for those who don’t speak geology—the very formation that’s creating a modest exploration rush in the NWT.

The activity pales in comparison to the Great Diamond Rush of the 1990s. But it represents perhaps the best hope for charting a future for mining in the territory as the diamond mines age—commercial production at Diavik is scheduled to end production in 2026—and many other potential projects are either still in exploration or struggling to raise financing. Lithium, in contrast, is the hot commodity. Prices for the metal have more than tripled since 2020 while demand, according to a report published by McKinsey & Co., could grow by as much as 30 per cent a year until the end of the decade on ravenous demand to develop and deploy electric-motor technology.

And the NWT has a bunch of the stuff.

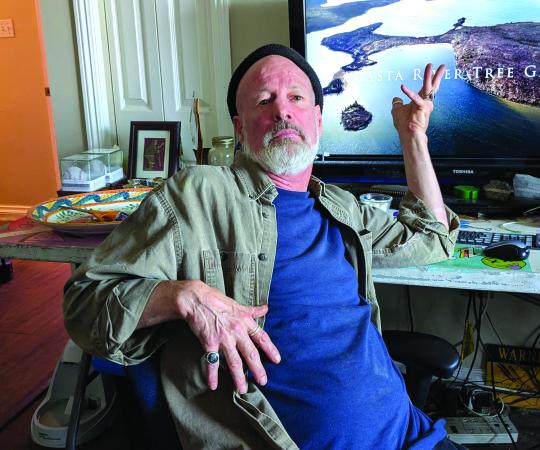

Given the potential, more than half a dozen companies have raised camps in the territory. They’re drilling known deposits and looking for more, which is bringing some light and excitement to an exploration scene that’s been short on both in recent years. It’s also creating fresh opportunities for junior explorers. “We saw what was happening with lithium,” says Ken Armstrong, CEO of North Arrow, which recently tacked to the metal in the face of waning investor interest in its portfolio of diamond projects. “We thought, ‘well, we really have two options here. We can be patient and wait for the diamond market to come back. Or we can pivot to something that’s in our professional backyard.

”North Arrow is hardly alone in that thinking, although it’s unique in that it explored for lithium in the NWT and Nunavut (and in the U.S.) before developing its focus on diamonds. The other firms are newer faces, largely juniors hailing from Vancouver, Toronto, and Australia. But they all share a common goal: to find and, hopefully, develop projects to meet a demand that, at the moment, appears insatiable.

What this means for the mining future of the NWT—and conceivably Nunavut, where there are at least two early-stage projects—is less clear. For starters, the race to discover and develop new lithium deposits is global. In Canada alone, there are more than 400 exploration projects now underway, according to the research firm Mining Intelligence, with almost half in Quebec and another quarter in Ontario.

Size matters, too. Scientists in the U.S., for example, recently announced the discovery of an ancient super-volcano on the Oregon-Nevada border that appears to hold what might be the largest lithium deposit ever discovered, possibly as much as 40 million tonnes. Meanwhile Pilabra Minerals Ltd, operator of the Pilgangoora mine in Western Australia, recently upgraded its resource estimate to more than 400 million tonnes of ore and potentially two million tonnes of lithium. The NWT doesn’t have to match those volumes to be a player, but the scale of a project plays a critical role in attracting investment.

Perhaps the biggest factor of all, however, boils down to one word: Timing.

Although lithium exploration companies are active in the Mackenzie Mountains and at Lac de Gras, the heart of the activity is taking place in a region known as the Yellowknife Pegmatite Province, which lies east of the territorial capital. Unlike the diamond rush of the 1990s—which exploded on the strength of a single discovery by a pair of dogged lone-wolf prospectors—these teams are treading well-known ground. The existence of the pegmatites was first noted in the 1940s by the geologist Alfred Jolliffe, a well-known figure in Yellowknife history. In 1952, they were documented by the Geological Survey of Canada. Several more studies were conducted over the following decades, including one by Superior Oil in the 1970s that estimated the resource at nearly 50-million tonnes of high-grade ore.

Nothing came of that work for a simple reason: The demand for lithium was too small to support mine development in a relatively remote region with high transportation costs. Indeed, the market for the metal has only recently become exciting. Nobody really knew what to do with it for the first century or so after its discovery. Eventually, uses for lithium, the lightest metallic element in the periodic table, began to emerge. By the 1920s, it had found applications in metallurgy, ceramics, glassmaking, and, later, in medicine in treating mood-related conditions such as bipolar disorder. (It was also a featured ingredient in 7Up, which launched in 1929 as a patent medicine to cure hangovers. The U.S. Food and Drug Administration banned the practice in 1948.)

That history is reflected in the story behind the claims now being explored by Li-FT Power, which has the largest land position in the Yellowknife province, including 13 spodumene pegmatites showing commercial grades. Some outcrops are large enough to see in satellite imagery on Google Earth.

“[Lithium] has been off everybody’s radar for so long,” says Li-FT CEO Francis MacDonald, launching into the tale of how his company acquired the dormant property from a geologist who ended up retiring on money he made from founding a restaurant chain in Vancouver and various real-estate investments. “This is really like a project from his past,” MacDonald continues. “He said he was just waiting for the right time and the right people to come along. So, we convinced him we were the right people, and this was obviously the right time for lithium. And we were able to acquire the project from him, 100 per cent.”

For MacDonald and his two-year-old firm, which also has holdings in Quebec and in the Nahanni Pegmatite Group in the Mackenzie Mountains, the appeal of lithium exploration goes beyond the obvious market potential. For starters, companies working in the NWT are exploring hard-rock formations. Developing these types of deposits is less costly than extracting the mineral from groundwater brines, which account for about half of world lithium production today. The margins achieved on brine production are generally higher compared to hard-rock deposits, according to S&P Global. But spodumene pegmatites have another quality that makes them attractive in the northern context: They don’t cost as much to explore as some of the North’s more traditional mineral resources.

“The way I got into lithium was, I was looking at how much needs to go into different deposit types in order to get to the feasibility stage,” MacDonald says, explaining his decision to move into lithium from an earlier focus on gold and copper. “For gold deposits similar to the Giant mine or Con, it takes 500,000 metres to two million metres [of drilling] to get to the feasibility stage… For lithium deposits, it was 10,000 to 15,000 metres—an order of magnitude less.”

The reason for the difference is simple. Unlike gold deposits—which can run like underground rivers that wind, narrow, dip, and change course—pegmatite formations tend to be compact and well-defined. It’s easier and cheaper to figure out their boundaries so that drilling can focus on issues such as whether the grade is economic and whether enough lithium can be recovered for the ore to make a business case.

Companies operating in the Yellowknife Pegmatite Province—which include North Arrow, which has the DeStaffney project and others such as the Australian firms Loyal Lithium Ltd. and Midas Minerals Ltd., Vancouver-headquartered Gamma Explorations Inc., and Toronto’s Ion Energy Ltd.— are also positioned to avoid one of the greatest barriers to northern investment—transportation infrastructure. The entire region hews closely to year-round and seasonal road systems. Some projects are a stone’s throw from the Ingraham Trail, a well-maintained recreational road that also connects to the winter road that serves the diamond mines (which happens to run within a few short kilometres of North Arrow’s Lac De Gras project). Better yet, that infrastructure, along with barging on Great Slave Lake, would put any future production of lithium concentrates within a few hours’ drive of a southbound rail connection in Hay River.

It’s also conceivable—in a speculative blue-sky sense—that NWT government hopes to expand hydroelectric generation and transmission capacity in the region might even bring renewable power to future projects. But that’s another conversation.

When you look at a list of the world’s largest lithium producers, it’s hard to find Canada. Australia leads by a wide margin. It accounted for 46 per cent of global production in 2022, according to the United States Geological Survey, followed by Chile and China, with 30 per cent and 13 per cent respectively. Canada did make the top 10, but only with a small contribution of one half of one percentage point.

The upside is that the volume of lithium production here is growing. In June, the federal government approved construction of a new mine in Quebec’s James Bay region, which is being developed by Australian-owned Galaxy Lithium (Canada) Inc. The project will be an open-pit operation that will produce an estimated 300,000 tonnes of ore concentrate annually for roughly two decades.

Earlier in the year, a joint venture between Australia’s Sayona Mining Ltd. and the U.S. firm Piedmont Lithium Inc. brought a Quebec lithium mine back into production following a three-year shutdown. According to news reports, it already counts Tesla Inc. and South Korea’s LG Chem Ltd. among its customers. It is also currently the only operating lithium mine in North America aside from a small Chinese-owned project in Manitoba that currently produces about 30,000 tonnes of concentrated ore annually, which is shipped back to China for processing. (Sinomine Resource Group Co. Ltd., the owner of the project, is looking to expand and joint venture on a lithium refinery in the province.)

So, in many respects, the NWT is not trailing the rest of the country in efforts to develop lithium resources. For Li-FT’s MacDonald the key to seeing a project North of 60 is discovering a resource in the neighbourhood of 100 million tonnes of ore grading above one per cent. (Lithium spodumene deposits carry other minerals in addition to the lithium itself. If the lithium concentration is above one per cent, the deposit starts to look economically feasible.) “I think there’s potential for that,” MacDonald says, noting that a hard-rock deposit of similar size in Brazil achieved commercial production this year, making it a good comparison for the potential of the Yellowknife province.

Additionally, there’s no imminent risk that new lithium projects will meet rising demand as they come online. The World Economic Forum predicts that the world could face lithium shortages by 2025. Investors are likely to factor how soon a project can achieve production into calculations just as much as the scale of the resources to be developed.

In other words, speed counts. “This isn’t diamonds, where the geology of the [NWT’s] Slave Geological Province is so unique,” says North Arrow’s Armstrong. “People are looking for lithium in Quebec, Ontario, and Manitoba—and in the U.S, Scandinavia, Brazil, South America, West Africa, and Australia… Getting deposits defined and then to production and then to market. there is an element where speed is going to be very important because of that global aspect.”

There are other, less tangible, factors that may play in the NWT’s favour. The desire to develop lithium supply chains that are not dependent on China for processing is creating broad-based opportunities. Closer to home, the exploration is taking place in areas where there is already significant industrial development, which may ease some the of challenges around sustainable land use.

And, at the end of the day, the world wants lithium, lots of it. And it will take time for production to rise to meet that demand. Nothing is written in stone, but the indicators suggest the NWT has a decent shot.